10 June 2025

How to hire employees in Spain without establishing a legal entity

Expanding into a new market often begins with building the right team. Spain is an attractive destination for many international businesses thanks to its skilled workforce, strategic location, and access to the broader EU market. But when you’re not ready to fully commit to opening a local entity, hiring employees compliantly can feel like a complex challenge.

In this guide, I’ll walk you through hiring talent in Spain without setting up a subsidiary. We’ll look at the legal and administrative requirements you need to be aware of, the risks of certain shortcuts, and how a Spanish Employer of Record (EOR) can help you get up and running quickly, with none of the usual overhead.

Why businesses want to hire in Spain without opening a legal entity

Let’s say you want to test the Spanish market before investing. Or perhaps you’ve found the perfect candidate for a remote role, but you don’t have a company registered in Spain. Setting up a subsidiary or branch office is one option—but it’s far from the only one.

More companies are looking for flexible hiring models that don’t require months of paperwork or significant upfront costs. Whether you’re a startup entering Europe for the first time or an established enterprise exploring new sales regions, hiring without a legal entity offers a faster way to scale and adapt.

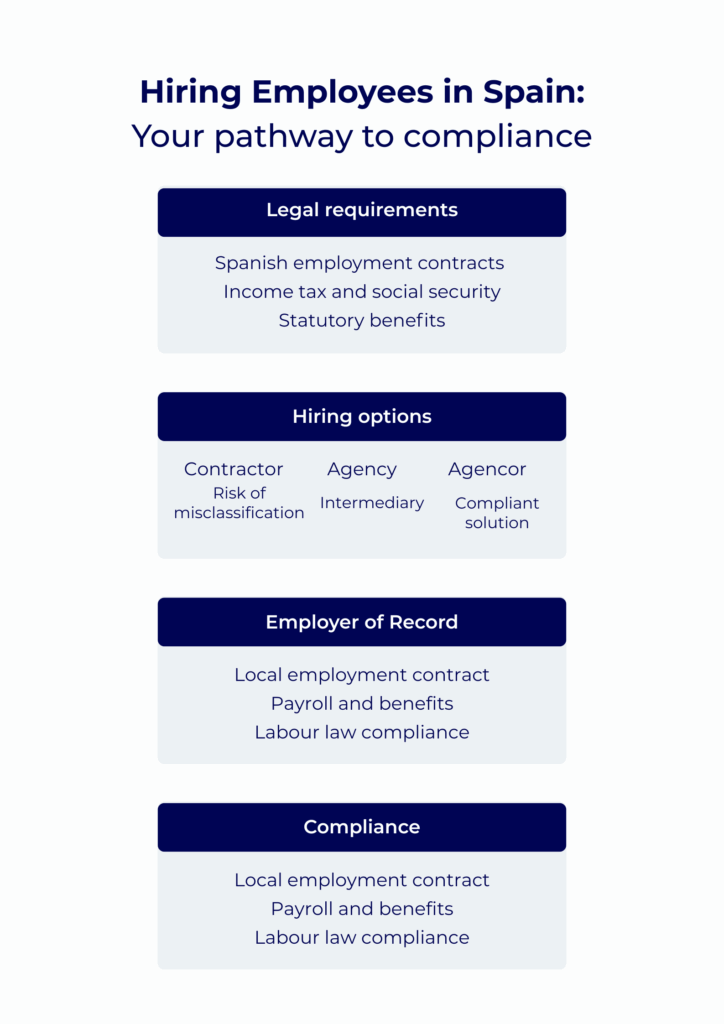

Legal requirements for hiring employees in Spain

Employment in Spain is tightly regulated. If you want to hire someone under a compliant, full-time contract, Spanish law requires you to act as an official employer. That means:

- Providing a written employment contract under Spanish labour law

- Withholding income tax (IRPF) and submitting it to Spanish tax authorities

- Paying social security contributions to cover benefits like healthcare, pensions, and unemployment insurance

- Ensuring statutory benefits like paid holiday, sick leave, and severance are in place

To manage all this, employers must register with Spain’s tax authority (Agencia Tributaria) and social security system (Seguridad Social). A foreign company cannot legally hire or pay Spanish employees without local registration.

Why setting up a legal entity isn’t always the best first step

If you go down the route of creating a subsidiary or branch in Spain, expect to go through several formal steps. You’ll need to:

- Choose a legal structure (often an S.L. or branch)

- Open a local business bank account

- Register with the Mercantile Registry (Registro Mercantil)

- Appoint local legal representatives

- Handle ongoing compliance with corporate tax filings, accounting, and labour regulations

This process can take several months and involve substantial legal and financial overhead. It’s not ideal if you’re just looking to hire one or two people, run a short-term project, or evaluate the market before committing to a full expansion.

Options for hiring without a legal entity

Some businesses explore hiring independent contractors as a workaround. While this might seem convenient, it comes with serious risks. Suppose a contractor behaves like a full-time employee, working fixed hours, reporting to a manager, or relying on your company for most of their income.

In that case, they may be considered an employee under Spanish law. Misclassification can lead to penalties, lawsuits, and back payments for unpaid taxes or benefits.

Other companies turn to freelance platforms or local staffing agencies. While these can help for short-term projects, they often lack the legal infrastructure to offer full-time, compliant employment.

Working with a Spanish Employer of Record (EOR) is the most effective and compliant option for international employers.

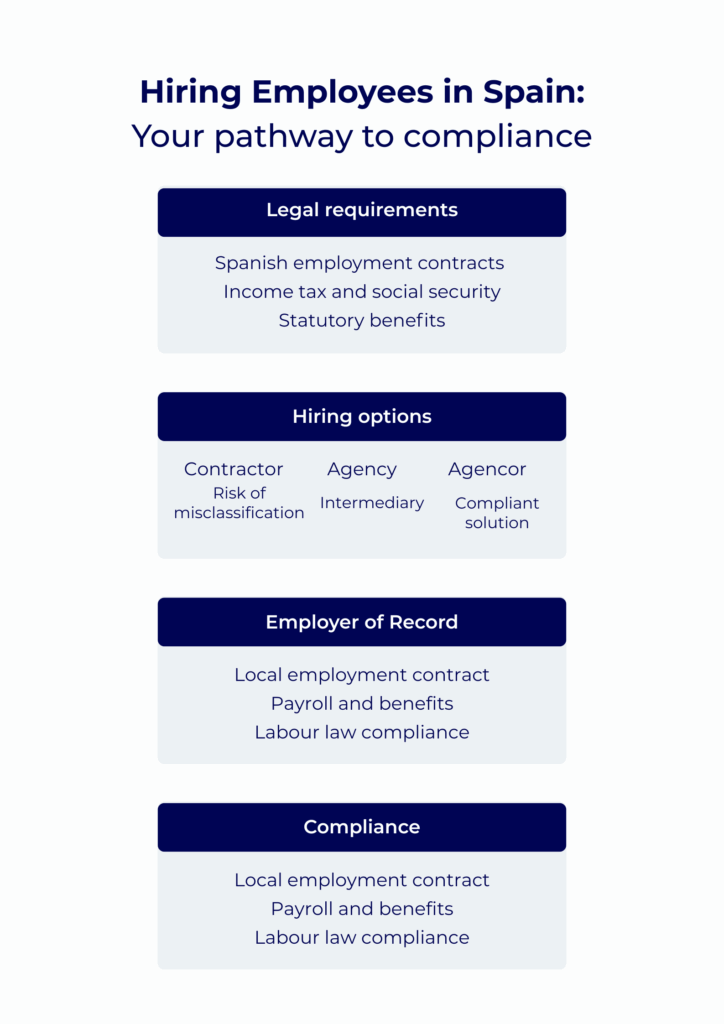

How an Employer of Record helps businesses hire in Spain without an entity

A Spanish EOR is a local organisation that becomes the legal employer of record for your workers in Spain, while you continue to manage their day-to-day activity. The EOR handles everything from contract setup and payroll to tax filings and benefits administration, ensuring your employees are fully compliant with Spanish labour law.

Here’s how it works:

- You select your candidate in Spain.

- The EOR issues a local employment contract and registers the employee with all relevant authorities.

- The EOR manages monthly payroll, social security payments, and ensures compliance with Spanish employment regulations.

- Your business maintains full control over the employee’s workload, goals, and performance.

This setup allows you to expand into Spain without opening a subsidiary, while offering your employees all the protections and benefits they expect under local law.

For example, a California-based fintech startup was ready to expand its customer support operations into Europe and identified Spain as the ideal location for hiring multilingual talent. However, setting up a Spanish subsidiary felt premature; they wanted to validate the market before committing to a full legal structure.

Instead, they partnered with a Spanish Employer of Record. Within days, the EOR provided locally compliant employment contracts, managed payroll, registered the new hires with tax and social security authorities, and ensured all benefits aligned with Spanish labour law.

The US team maintained full control over work outputs, while the EOR handled everything behind the scenes. This approach allowed the company to scale quickly and compliantly, without getting bogged down in bureaucracy.

When is an EOR the right solution?

Hiring through an EOR is ideal for:

- Market entry pilots: You want to explore Spain without the cost or commitment of a legal entity.

- Remote talent acquisition: You’ve found a great candidate in Spain and want to employ them compliantly.

- Short- or medium-term projects: You need to hire a small local team for a specific initiative.

- Scaling without infrastructure: You want to build a presence in Spain gradually, without overwhelming your HR and legal teams.

With an EOR, you get the agility to hire at speed, while staying fully aligned with local employment law.

Compliance considerations when hiring in Spain

It’s important to understand that Spanish labour law is protective of employees, and non-compliance is taken seriously.

If you hire someone in Spain without proper contracts or fail to register with authorities, you could face:

- Fines and penalties from tax or labour authorities

- Claims for misclassification and unpaid benefits

- Obligations for retroactive tax or social security payments

To stay compliant, you must ensure:

- Each employee is properly classified and protected under law

- Benefits like holiday, sick leave, and maternity/paternity leave are provided

- Payroll and tax reporting are handled accurately and on time

Working with a local EOR reduces the risk of these mistakes by outsourcing your compliance to local experts who are familiar with the regulations.

Hire employees in Spain

Hiring employees in Spain doesn’t have to mean setting up a legal entity or getting buried in administrative work. If you’re looking to build a presence in Spain, test the market, or onboard top local talent quickly, working with a Spanish Employer of Record offers a fast, cost-effective, and fully compliant solution.

You’ll be able to focus on building your team and growing your business, without worrying about local legal structures, tax filings, or employment regulations.

Ready to hire in Spain without setting up a company? Get in touch with our team to explore how our Employer of Record in Spain can help you build your team legally and efficiently.