4 August 2025

Working remotely in Spain for an international employer: what you need to know

In today’s distributed workforce, more professionals are choosing to live in Spain while working remotely for companies abroad. Whether you’re an expat chasing the Mediterranean lifestyle or a global employer supporting remote relocations, working remotely in Spain sounds simple—but it comes with complex legal, tax, and social security implications.

If you’re asking:

- Can I legally work remotely from Spain for a foreign company?

- Will I have to pay Spanish taxes?

- What about social security or a work visa?

You’re not alone. In this guide, we’ll walk you through:

- Residency and visa requirements

- Tax residency rules

- Social security and employment classification

- How a Spanish Employer of Record (EOR) can make it all compliant

Is it legal to work remotely from Spain for a foreign company?

Yes, it can be legal—but only if certain conditions are met.

The Spanish government doesn’t prohibit remote work for foreign employers, but they do expect compliance in three key areas:

- Visa or residency status

You must have legal permission to reside in Spain. Some visas (like tourist visas) prohibit working—even remotely. - Tax residency

If you live in Spain for more than 183 days in a year, you’ll likely become a Spanish tax resident—even if you’re paid from abroad. - Employment classification

Are you a freelancer, contractor, or employee? Misclassification can lead to fines, both for you and your employer. - Permanent establishment (PE) risk

If you’re an employee and your presence in Spain benefits the company materially, your employer might trigger corporate tax obligations locally.

Bottom line: It’s legal to work remotely from Spain for a foreign company, but you and your employer must align on immigration, tax, and employment law requirements.

Visa and residency requirements for remote workers

To work legally in Spain, you need to secure a valid visa or residence permit that allows remote work. Your options vary depending on your nationality and employment status.

Common visa options:

- Digital nomad visa

Introduced in 2023, this visa lets non-EU/EEA citizens live in Spain while working remotely for foreign employers. Requires proof of income, a clean record, and health insurance. - Non-lucrative visa

Designed for retirees or individuals with passive income. Note: It does not permit active work. - Highly qualified professional visa

If your role shifts into formal employment with a Spanish entity, this may apply. - EU/EEA citizens

Enjoy freedom of movement and can live and work in Spain without a visa—but must still register locally.

Key distinction:

Residing legally in Spain doesn’t always mean you can work—and vice versa. Always confirm that your visa covers remote work activity.

Tax residency and income tax obligations

Living and working in Spain—even for a non-Spanish company—can trigger tax residency.

183-day rule:

If you spend more than 183 days in Spain within a calendar year, you’re generally considered a Spanish tax resident. This means:

- You must pay income tax on your worldwide earnings in Spain.

- You’ll need to file Spanish tax returns and may need to declare foreign assets (Modelo 720).

Double taxation agreements (DTAs):

Spain has DTAs with over 90 countries to avoid double taxation—but applying them correctly can be complex. Consult a cross-border tax advisor.

The Beckham Law:

Remote workers on the digital nomad visa may benefit from the Beckham Law, which:

- Offers a 24% flat tax rate on income up to €600,000.

- Applies for up to six years if eligible.

Still, registration and tax reporting are required. No matter where your employer is, you can’t avoid Spanish tax obligations if you’re living there long term.

Social security and employment classification

Remote work raises the question: Where should social security contributions be made?

Two main options:

- Home country social security (A1 certificate)

If you’re seconded temporarily from the EU/EEA, an A1 certificate may let you stay in your home system for up to 24 months. - Spanish social security (Seguridad Social)

If you’re working in Spain long term—especially as a resident—you’re likely required to contribute to the local system.

Why classification matters:

- Freelancers must register with the Spanish tax office and social security system (RETA) and file taxes quarterly.

- Employees must be registered by their employer and receive payslips, benefits, and protection under Spanish labour law.

- Misclassified contractors (really employees in disguise) can trigger legal consequences for both parties.

Getting this right is critical—and where many remote setups fall short.

How a Spanish Employer of Record can help you work legally from Spain

If your employer doesn’t have a legal presence in Spain but wants to retain you as a full employee, an Employer of Record (EOR) is the best solution.

What does a Spanish EOR do?

- Acts as your legal employer in Spain, while you continue working for your original company.

- Issues a Spanish employment contract.

- Handles your payroll, tax withholdings, and social security contributions.

- Ensures full compliance with Spanish labour law.

- Manages onboarding and HR support, locally.

It’s a win-win:

- You enjoy local employment status, healthcare, pension, and tax clarity.

- Your employer retains your talent without opening a Spanish entity or taking on PE risk.

Choosing the right path: contractor, employee, visa holder, or EOR

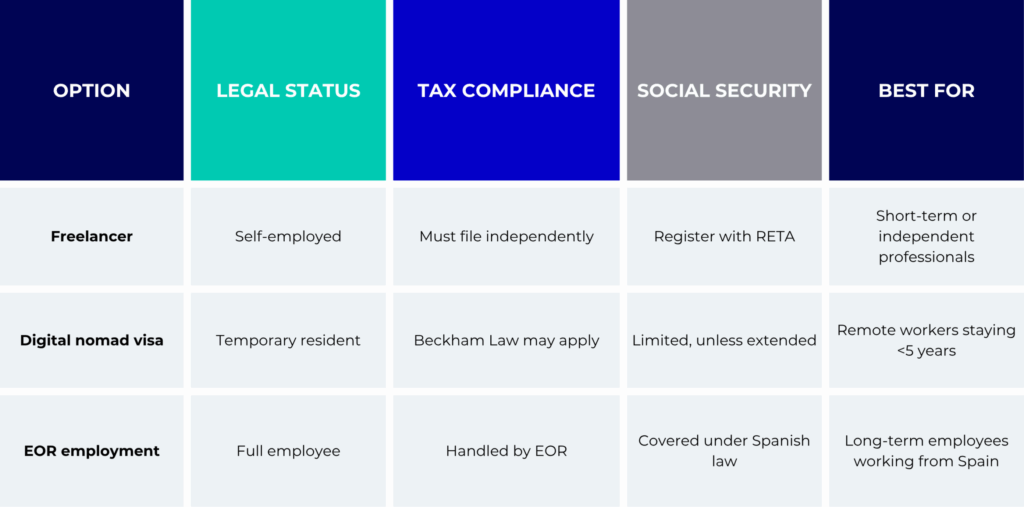

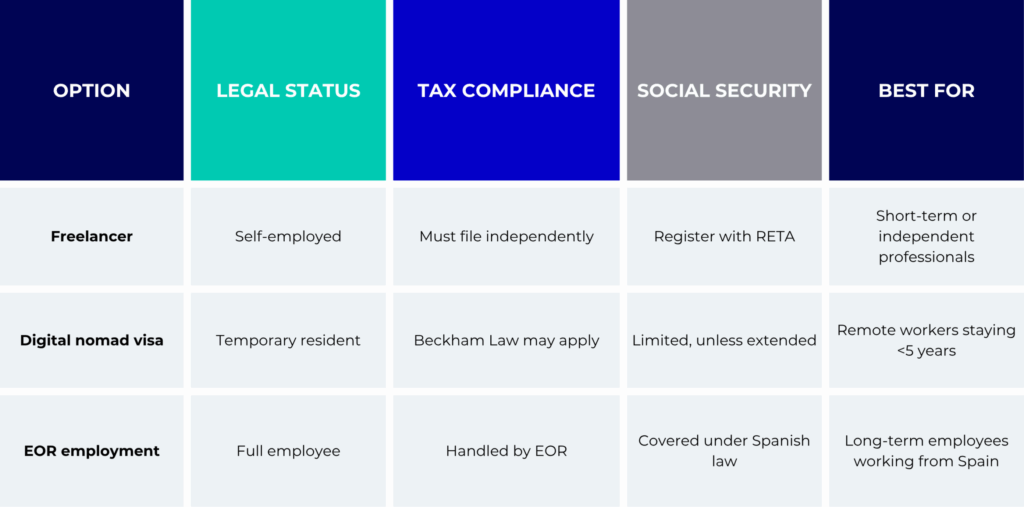

Here’s a comparison to help you decide the right route:

Working remotely in Spain is an exciting opportunity—but it’s not as simple as packing your laptop and booking a flight.

To live and work legally in Spain, you and your employer must understand:

- Immigration and visa requirements

- Local tax residency and reporting

- Social security and classification rules

If your employer isn’t set up in Spain, a Spanish Employer of Record offers a safe, fully compliant path to legal employment—giving you the freedom to live in Spain while keeping your job abroad.

Contact us to explore EOR solutions for working remotely from Spain—without the legal headaches.